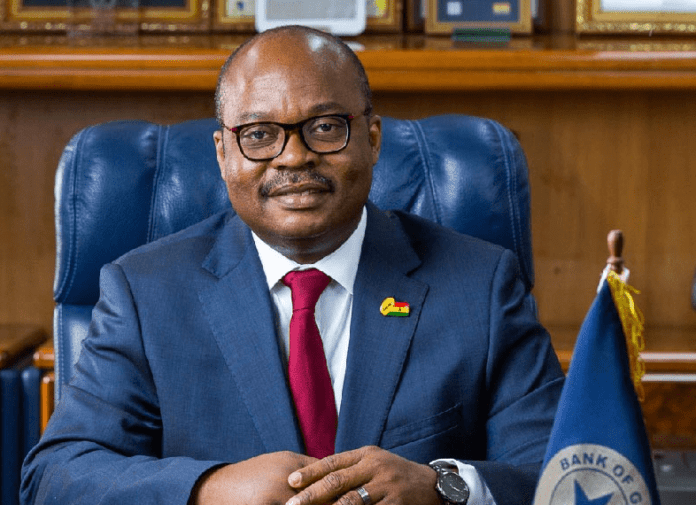

Governor of the Bank of Ghana, Dr. Ernest Addison, has called on the African investor community and stakeholders to leverage the expertise of the large technologically savvy, and youthful population on the continent for a successful intra-African payment system.

Speaking on the topic of ‘Scaling up Mobile Interoperability to Deepen Financial Inclusion and Intra-African Trade’ at the 2024 edition of the African Prosperity Dialogue, the governor of the central bank said scaling up mobile interoperability across the continent calls for a review of legacy payment infrastructures, better policy coordination among member countries, effective public-private and joint international collaborations that leverage new technologies such as cloud-based infrastructure, distributed ledger technology (DLT), and regulatory sandbox initiatives.

“The way forward is for African countries to leverage on the large technologically savvy and youthful population in shaping the future of payments to drive financial inclusion, intra-trade activities, and promote economic growth overall,” he stated.

“These developments present an opportunity to transform the continent’s payment landscape in a way that removes barriers for cheaper and more convenient cross-border transfers, as well as reduced settlement times. While this is almost a unanimous consensus belief, the challenge has been to decide on the best approach to achieving such a feat,” Dr. Addison added.

He noted that while the Pan-African Payment and Settlement System (PAPSS) was designed to facilitate safe, effective, and interoperable financial transactions across African borders, the biggest barrier is that only a small number of African nations have attained full interoperability, which restricts the potential to fully realise the benefits associated with scaling mobile money interoperability.

“This brings up pertinent legacy challenges that need to be addressed in this direction; prominent among which are inadequate payment infrastructure and inconsistent compliance, status of the regulatory frameworks, policy coordination, user education and security, and fraud concerns,” said the Bank of Ghana boss.

Dr. Addison further touched on some of the challenges that impede the success of attaining intra-African trade and payment systems.

“Few initiatives toward fostering mobile money interoperability at the intra-Africa level have been attempted in the past. However, lack of a collaborative approach and divergence in the developmental levels of national payment systems across Africa—notably lack of regulatory frameworks’ harmonisation in the payment systems, including the payments service provider (PSP) licencing requirements, know your client/customer due diligence frameworks, financial and consumer protection provisions, financial dispute resolution processes, foreign exchange access and reporting regimes, data protection, and cross-border sharing—have led to untimely failures. Hence, overcoming these roadblocks requires concerted efforts,” said Dr. Addison.

In keeping with the African Free Continental Trade Area (AfCFTA), he pointed out that mobile money interoperability continues to be a crucial component of the payment market infrastructure that can increase cross-border payments on the continent.

In order to solve the unique problems facing the region, the governor further urged all parties involved to work together to create an ecosystem that supports interoperability.