The government of Ghana has been told to take drastic measures to curtail rising domestic debt otherwise, the country will soon go through another round of debt restructuring just as what happened before the 3Billion International Monetary Fund (IMF) deal was approved.

This caution which was given by the Chief Operations Officer at Dalex Finance Mr Joe Jackson was the heels of the warning Fich gave to Ghana against the rising interest cost on domestic debt despite securing the $3billion deal from the Fund.

According to Fitch, rising interest cost on domestic debt does not help with the overall debt sustainability in the medium term.

Speaking at a webinar on Africa Sovereigns Amid Financing Crunch, Senior Director for Emerging Markets, Toby Iles, cautioned Ghana and other African governments against the rising interest costs on domestic markets.

“As I mentioned right at the beginning, there has been more development in the domestic debt market and so it’s become more important. When we look at things in terms of interest cost of the government; break them down by domestic debt interest cost and compare them with external interest cost, the share of interest cost on domestic debt has been going up. So domestic debt becomes more of a question mark,” he said.

Toby Iles added that the terms of the debt restructuring might not help in the overall debt sustainability.

“Terms of the actual restructuring: it definitely helps in terms of liquidity but it doesn’t help in the overall debt sustainability over the medium term. It presupposes there will also be other fundamental improvements in fiscal consolidation,” he added.

Reacting to this development, Mr Joe Jackson who is also a Financial Analyst asked the government to downsize as a way of reducing cost.

Failure to cut down the size of appointees, he said, would amount to ‘robbing Peter to pay Paul’ in the management of the domestic debt situation.

Interest rates on Treasury bills (T-bills) have been going up after falling drastically to about 18 percent in March 2023 from 35 per cent, raising concerns about a probable restructuring of the short-term securities.

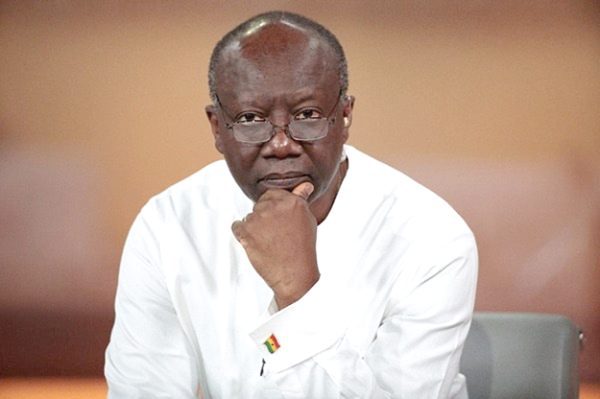

Speaking on the Business Focus with Paa Kwasi Asare on TV3 Monday, July 3, Mr Jacskon said “has the government actually cut costs? The IMF deal has been signed, we are all waiting for the day for the budget review whether we are still going to borrow but ultimately the government has to cut costs far more than it has done today.

“We have heard the Finance Minister say that over 20 percent of all our borrowings is a result of State-Owned Enteprises (SOEs) but can’t we cut down the size of SOEs, why can’t you cut the size of appointees otherwise we are just robbing Peter to Pay Paul.”

He added “If we don’t pull the brake we will soon have to restructure our debts again, we cannot sustain interest rates at this level for any less time. If we don’t fix it, somewhere we are going to come back and restructure some of the debts again.”