Credit rating agency, Fitch has said that they believe the International Monetary Fund (IMF) assistance will improve economic conditions in Ghana and therefore limit risks to social stability over the coming quarters.

Following the formation of an official creditor committee, the IMF approved Ghana’s USD3.0bn Extended Credit Facility in May, which led to an immediate USD600 million disbursement.

Fitch said in a statement that “This will shore up the country’s foreign exchange reserves, which had fallen to USD5.2bn in April (2.5 months of import), and help meets Ghana’s external financing needs.

“These developments have improved sentiment towards Ghanaian assets, with the cedi having strengthened by 8.0% in May, which will reduce imported inflation over the coming months. Indeed, we believe that consumer price growth will remain on a downward trajectory through 2023 and 2024 (see chart below), easing pressure on household finances.”

Below is the full statement…

Key View

.We believe that IMF assistance will improve economic conditions in Ghana and therefore limit risks to social stability in 2023 and 2024.

.The government will likely meet IMF targets over the coming months as opposition lawmakers will only offer modest pushback against economic reforms.

.We believe that the opposition National Democratic Congress is best placed to win the December 2024 general election as fiscal consolidation weakens the incumbent government’s campaign agenda.

We believe that IMF assistance will improve economic conditions in Ghana and therefore limit risks to social stability over the coming quarters. Following the formation of an official creditor committee, the IMF approved Ghana’s USD3.0bn Extended Credit Facility in May, which led to an immediate USD600mn disbursement, with another USD600mn expected in Q423.

This will shore up the country’s foreign exchange reserves, which had fallen to USD5.2bn in April (2.5 months of import cover; see chart below), and help meet Ghana’s external financing needs.

These developments have improved sentiment towards Ghanaian assets, with the cedi having strengthened by 8.0% in May, which will reduce imported inflation over the coming months. Indeed, we believe that consumer price growth will remain on a downward trajectory through 2023 and 2024 (see chart below), easing pressure on household finances.

Despite fiscal consolidation efforts under the IMF programme, economic stabilisation and moderating price growth will yield net positive outcomes for Ghanaian households. While the government has raised taxes (including income taxes and VAT) in H123, a more stable exchange rate, easing inflation and a stronger external position will gradually normalise economic conditions. We believe that this will lower protest activity in H223, after the number of protests and riots increased by 17.2% y-o-y in H123 (see chart below).

To reflect this, we have revised up the ‘social stability’ score in our Short-Term Political Risk Index (STPRI) to 47.5 out of 100, from 40.0 previously (higher score implies lower risk).

Ghana’s headline STPRI score now stands at 63.1, from 59.4 before. The country remains a regional outperformer, with the average Sub-Saharan Africa STPRI score standing at 50.3, implying that political risks remain relatively contained in Ghana.

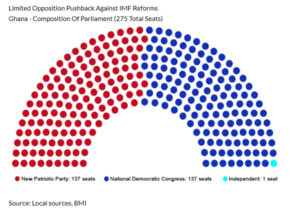

Despite Ghana’s split parliament, we believe that the government will be able to introduce most IMF-related reforms over the coming months. Ghana’s programme is in part focused on improving fiscal dynamics by raising revenues and decreasing expenditure, implying that the government will seek to implement additional fiscal policy changes in the months ahead.

Opposition lawmakers have been able to offer significant pushback against former legislative proposals (such as the e-levy in 2022) given that the National Democratic Congress (NDC) has an equal number of seats in the National Assembly as the ruling New Patriotic Party (NPP; see chart below).

However, given that NDC leader John Mahama called on the government to seek IMF assistance in early 2022, pushback against IMF-related reforms could negatively impact the NDC’s credibility going into the December 2024 general election – something we believe the opposition will aim to avoid.

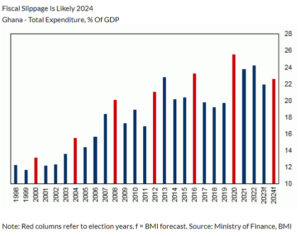

That said, there is a risk the government fails to meet its IMF targets in 2024. Since the start of this decade, total expenditure as a share of GDP increased by an average of 3.0 percentage points during election years (see chart below), signalling that some level of fiscal slippage is likely in 2024.

Nonetheless, higher-than-budgeted for expenditure is unlikely to lead to a suspension of the IMF programme. Indeed, when public expenditure surpassed budgetary allocations in 2016 (an election year), the IMF board approved waivers for non-observance of performance criteria and decided to extend the arrangement by one year.

As such, anticipated fiscal slippage in 2024 is unlikely to result in a loss of investor confidence, which – in turn – would weaken the cedi and drive up inflation, and could lead to greater social unrest.

Turning to the 2024 general election, we believe that the NDC is most likely to win.

The rapid deterioration of economic conditions in 2022 and slow progress in the fight against perceived corruption – in a July 2022 Afrobarometer study, 85.0% of Ghanaians believed the government was doing a poor job in tackling corruption – will exacerbate anti-incumbency sentiment among the electorate.

In addition, the IMF has voiced concerns over President Nana Akufo-Addo’s flagship Free Senior High School programme (introduced in 2017), labelling it as “poorly targeted”. Potential modifications to the programme in order to rein in spending could weaken the NPP’s campaign agenda, increasing the chances of an NDC win.

Despite our view that a government change is likely after the 2024 general election, we believe that risks to Ghana’s IMF programme are limited.

Previous NDC governments have requested IMF loans (Ghana’s 2015-2019 IMF programme was started under an NDC government) and current NDC leadership has expressed support for Ghana’s re-engagement with the IMF.

Given the limited risks to the IMF programme, we have revised up Ghana’s ‘policy continuity’ score in our STPRI to 70.0 out of 100, from 62.5 previously.